Dogecoin Under Pressure: Only Top 10 Coin Where Loss-Taking Exceeds Profit

On-chain data shows Dogecoin is the only cryptocurrency among the top 10 where investors are currently realizing more losses than profits.

Dogecoin Investors Realized $124 Million In Loss Over The Last 24 Hours

In a new post on X, the on-chain analytics firm Glassnode has shared how the major cryptocurrencies compare against each other in terms of the Realized Loss and Realized Profit metrics.

These indicators measure, as their names already imply, the amount of loss/profit that the investors on a given network are realizing through their transactions right now.

The metrics work by going through the transfer history of each coin being sold to see what price it was moved at prior to this. If this previous value is less than the price that the coin’s now being sold at, then the token’s sale is leading to profit realization. On the other hand, it being higher suggests loss realization.

The Realized Profit sums up the difference between the two prices involved in all sales of the former type, while the Realized Loss does the same for the latter ones.

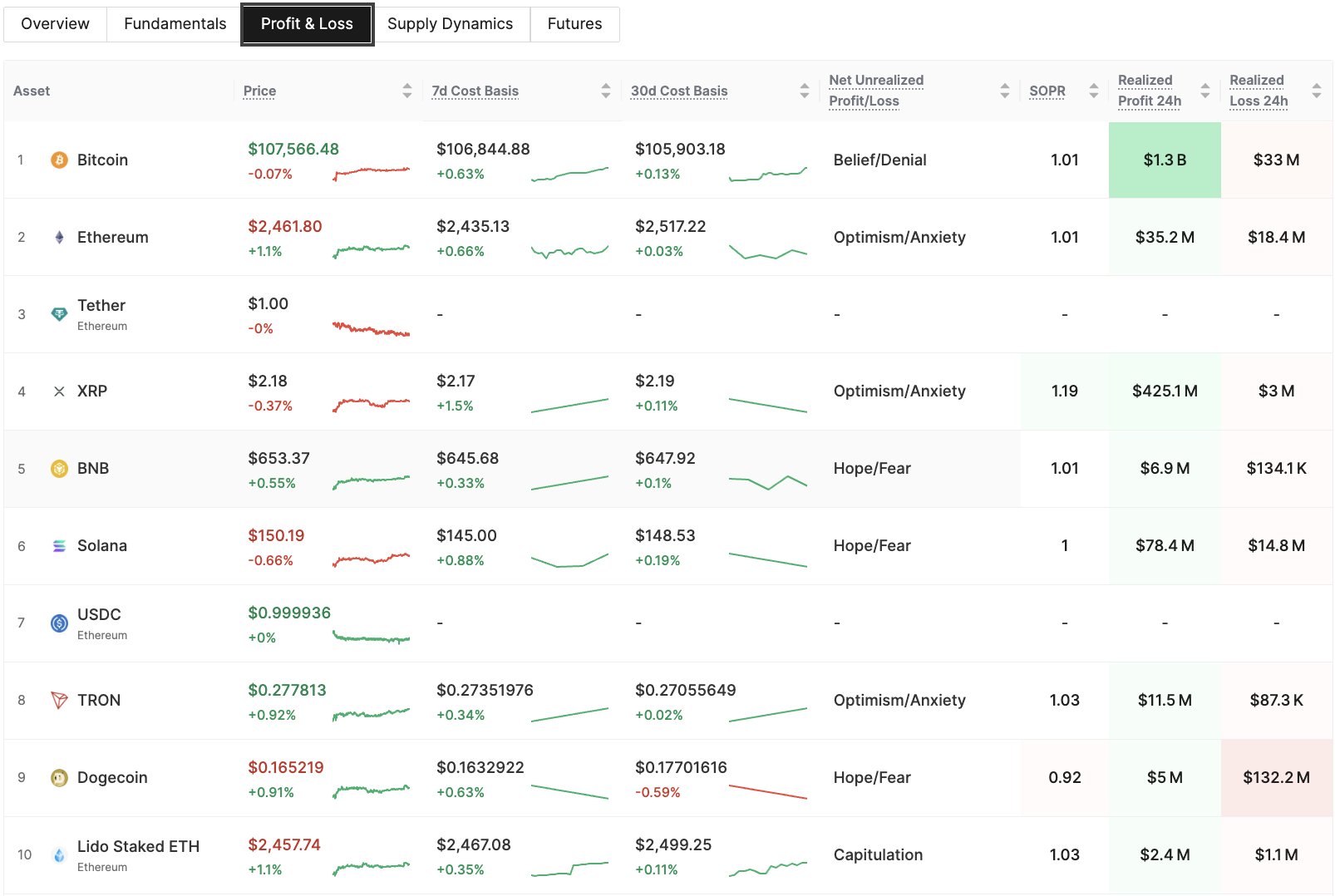

Now, here is the table shared by the analytics firm that shows how the 24-hour values of the two metrics currently stack up for the top 10 coins by market cap:

As is visible above, the scale of the Realized Loss and Realized Profit differs greatly between the different assets, but one pattern is consistent: the latter outweighs the former, implying a trend of net profit-taking from the investors.

One asset, however, doesn’t fit the mold: Dogecoin. The 24-hour Realized Loss for the memecoin stands at around $132 million, while the Realized Profit is much lower with a value of just $5 million.

As such, it would appear that while the participants in the rest of the sector have been harvesting gains, DOGE holders have been panic capitulating at a loss instead.

Among these top coins, the investors of Bitcoin have realized the largest profit, with the indicator’s value sitting at a whopping $1.3 billion. The Realized Loss is also restricted to just $33 million for the number one cryptocurrency, indicating selling has been heavily lopsided toward profit-taking.

Things are more balanced for Ethereum, the digital asset ranked number two. Its Realized Loss of $18.4 million is roughly half that of its Realized Profit of $35.2 million.

The fact that profit realization is so dominant for the likes of Bitcoin, however, might actually be a bearish sign. Historically, such market conditions have made tops more likely. A dominance of loss-taking, on the other hand, can facilitate reversals to the upside. As such, while not a given, Dogecoin may not be in a bad position, at least in this regard.

DOGE Price

Dogecoin touched the $0.170 mark during the weekend, but the memecoin has seen a retrace under $0.165 to kick off the week.