Bitcoin v. gold is ‘canary in the coal mine’ about to drop, warns strategist

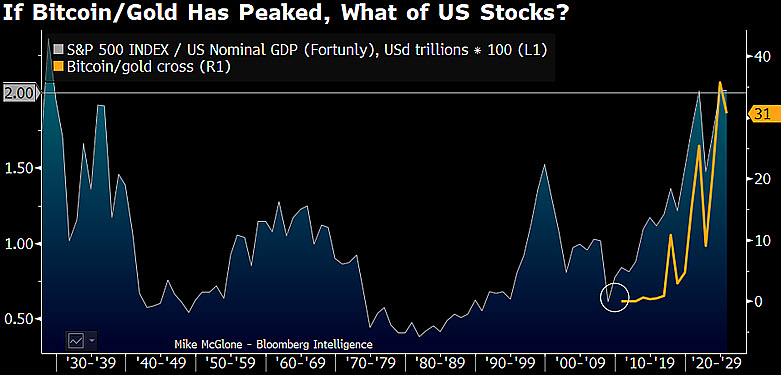

Bloomberg Intelligence senior commodity strategist Mike McGlone has warned that Bitcoin’s (BTC) weakening performance relative to gold could be signaling deeper trouble for U.S. equities and broader risk assets.

In his bearish outlook, McGlone pointed to the falling Bitcoin-to-gold ratio as a potential “canary in the coal mine.” He emphasized that the 33x level on this ratio is a critical threshold for maintaining investor confidence in riskier markets, as per his X post on June 22.

“Falling Bitcoin vs. gold could be a canary in the coal mine for risk assets, putting an inordinate burden on the cross to stay above 33x,” he said.

The caution comes amid a backdrop of historic market turmoil. Specifically, the S&P 500 fell nearly 20% in the first half of the year, wiping out around $13 trillion in market capitalization, over 40% of U.S. GDP.

McGlone noted this marked the largest GDP-relative loss for a 20% correction in nearly a century, highlighting the severity of current market conditions.

He backed his concerns with a comparison where the stocks have surged to record highs, but the Bitcoin/gold ratio has stumbled.

Investors losing faith in Bitcoin?

This divergence suggests that while equity valuations remain elevated, investors are losing faith in Bitcoin as a high-beta, risk-on asset, especially compared to gold’s safe-haven appeal.

McGlone warned that unless Bitcoin begins to regain ground against gold, further declines in equities and speculative assets may follow.

So far in 2025, gold has emerged as one of the year’s top-performing assets, with investors seeking refuge amid persistent uncertainty.

Safe-haven demand has been fueled by rising trade tensions and escalating conflict in the Middle East, which intensified after U.S. airstrikes on Iranian targets. As a result, gold is on track for record inflows, with projections nearing $80 billion this year.

Bitcoin, meanwhile, has mostly held above the $100,000 level but briefly dipped below that key support amid geopolitical jitters. Analysts warn that sustained losses below this threshold could trigger a deeper correction, potentially sending the asset toward $80,000.

Featured image from Shutterstock

Adblock test (Why?)