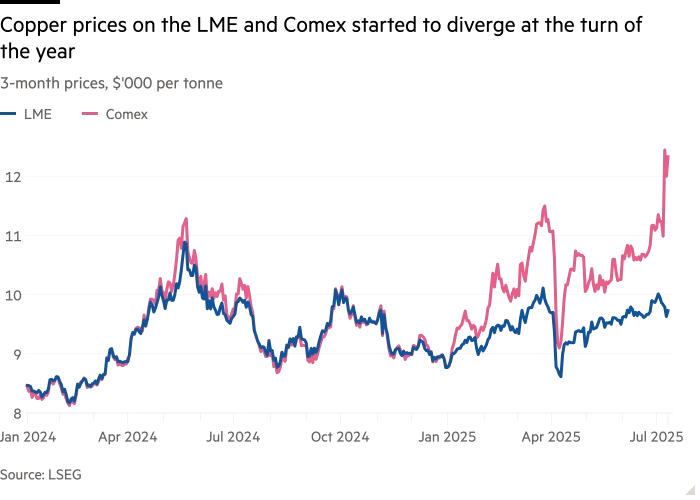

U.S. Copper Tariff Spurs Record-Breaking Trading Gains

Just days after President Trump revealed a surprise 50% tariff on imported copper, commodity markets erupted. Copper prices on COMEX spiked 13%, creating a rare 28% arbitrage window versus LME prices .

Seizing the moment, major traders—Trafigura, Mercuria, Glencore, and IXM—rushed approximately 600,000 tonnes of copper into the U.S., converting global supply into home-market profit opportunities .

Even after logistics and handling costs (around $500/tonne), traders netted roughly $520/tonne, amounting to a combined $312 million windfall . The surge in imports notably stemmed from:

- Trafigura: ~200,000 tonnes

- Mercuria: nearly 200,000 tonnes

- Glencore: 100,000–200,000 tonnes

- IXM: over 50,000 tonnes

This arbitrage frenzy reflects a broader pattern of market dislocations triggered by tariff-driven price anomalies—echoing similar events earlier this year in gold and aluminum .

Impact highlights:

- Record arbitrage profit: One of the richest metal-trading opportunities in years.

- Global inventory squeeze: Flooding U.S. warehouses is draining metal from LME markets.

- Policy risk warning: The tariff-triggered boom underscores how swiftly trade policy can reshape commodity dynamics.

Investors should watch for ripple effects: from shifts in global supply chains, inflationary pressures in copper-intensive industries, to strategic moves by miners responding to the COMEX price premium .