I’m 51, earn $129K and have $165K in my 401(k). Can I afford to retire when my husband, 59, draws Social Security at 62?

I really appreciate your column and the advice you provide. I have been considering “retiring” early to have more time with my husband during our younger years. We were both married for more than 20 years each. We met when I was 46 and he was 54. Our divorces did cause us quite a bit of financial loss, and we have $105,000 in combined debt, not including our house payment, which is $2,200.

I’m currently 51 years old, and my husband is 59. He is retired from a state job and receives a pension that nets around $3,600 per month, as well as lifelong health insurance for both of us. Once he reaches 62, we estimate his Social Security will provide approximately $1,800 net per month. In four months, he can cash out a Roth IRA, which would pay off our outstanding debt, minus our house.

I earn $129,000 per year. I contribute 15% to my 401(k), which is currently valued at $165,000. I also rolled over an old 401(k) with $125,000 to be managed by a financial adviser. Can I quit working in three years — when my husband begins collecting Social Security? I plan to stop contributing to my 401(k) at that point. How much do you anticipate my account would be worth when I reach 59 1/2?

The money my financial adviser manages has been earning approximately 9% per year, and my employer matches 6% of my compensation. We would be downsizing our house and likely moving to a state with lower property taxes (we currently live in Texas). What do you think I should do? Should I retire early and join my husband on this new adventure? Thank you in advance for your advice.

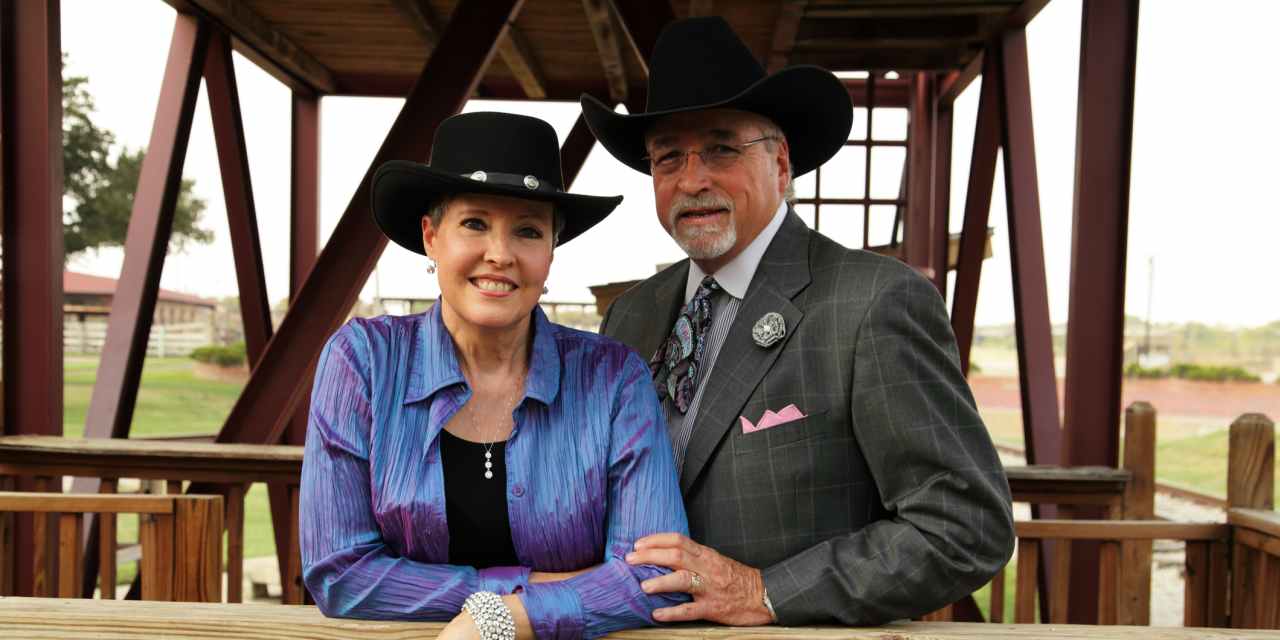

The Wife

Related: ‘This flies in the face of my morals and ethics’: My father cut my sisters out of his six-figure estate. Should I push back?

Dear Wife,

Think twice before you retire early.

Your husband will have to pay 40% of his combined pension and Social Security on your house payment, and that’s after he uses his Roth IRA to pay off your combined debt.

Even if your $165,000 401(k) were worth $195,000 after three years — assuming a relatively conservative 6% growth — you would still need that money to last you for another 30 years. It’s simply not enough, even with your husband’s state pension. You won’t be able to make withdrawals from your 401(k) for another eight years and you too may be forced to take your Social Security benefits before your full retirement age.

By claiming his Social Security at 62, he is also settling for significantly less than his full amount if he waited. You have a long wait until you qualify for Social Security, and your slightly throwaway comment that your husband will cash out his Roth IRA to pay your debts also gives me pause. You have a relatively secure six-figure income and your employer is contributing a 6% match, so why throw that away now just because your husband is ready to retire?

Unless you absolutely hate your job and you feel like it’s making you sick, there’s a lot to be said for these peak earning years.

Unless you absolutely hate your job and feel like it’s making you sick, there’s a lot to be said for these peak earning years and the meaning, social contact and structure that work brings you. You might miss it when it’s gone and, even if you’re glad to see the back of it, you will certainly miss the financial independence and security of knowing that you are building a nest egg for retirement. Do you really want to be that dependent on your husband?

Let’s say, for the sake of argument, that you had $400,000 collectively in both 401(k)s in three years. Using the 4% rule — withdrawing 4% of your nest annually over a 30-year period — you would take out $16,000 a year. U.S. adults, on average, say they’ll need $1.46 million to retire comfortably, up 15% over the $1.27 million reported last year, according to a recent study by Northwestern Mutual. That doesn’t put you in the crosshairs for an easy retirement.

Keep doing what you’re doing

You’re doing OK. Keep at it. Some 75% of non-retired adults had at least some retirement savings, but 25% had no retirement savings, according to one report by the Federal Reserve. Oftentimes, the clue is in the question. If you are that worried about your ability to retire, keep working and accumulating savings. You want more leisure time with your husband, but will you also have more security and more peace of mind?

The Social Security Administration and AARP provide retirement calculators that help determine whether you have enough money to retire. (As for your other point, Hawaii has the lowest property taxes, per this guide from SmartAsset. But that doesn’t necessarily mean a lower cost of living.) You can input your assets, projected retirement spending, life-expectancy assumptions and tax estimates. Longevity is a big unknown. The average U.S. female who reaches 65 can expect to live to around 86.7, according to the SSA.

It’s great that you are in a happy marriage; that will help you in your retirement years, but will your income match your retirement goals?

If you retire at 54, could you hold off on claiming Social Security until you can maximize your benefits at 70? Many people — 28.4% of men and 26.5% of women — take Social Security when they reach full retirement age, which is between 65 and 67, depending on the year a person was born. Meanwhile, 8.4% of men and 9.3% of women wait until at least 70 to take their benefits, according to the SSA.

I wonder how much early retirement, as exciting as the prospect might be, is your idea and how much is pressure from your husband, who is understandably eager to embark on his new post-work life. Planning can be fun too. What kind of retirement would you like after you downsize and move to a new state? It’s great that you are in a happy marriage; that will help you in your retirement years, but will your income match your retirement goals?

Longevity and lifestyle requires a healthy investment income.

Related: ‘My wife and I are very grateful’: Our son wants to pay off our mortgage before we retire. Will this backfire?

You can email The Moneyist with any financial and ethical questions at qfottrell@marketwatch.com. Check out the Moneyist private Facebook group, where we look for answers to life’s thorniest money issues. Post your questions, tell me what you want to know more about, or weigh in on the latest Moneyist columns.

The Moneyist regrets he cannot reply to questions individually.

Previous columns by Quentin Fottrell:

My husband will inherit $180K. I think we should invest the money. He wants to pay off his $168K mortgage. Who’s right?

‘I’m at a loss’: My boyfriend of nearly 10 years is naming his elderly parents as beneficiaries and giving them power of attorney. Am I right to be upset?

‘We have no prenuptial agreement’: Will my wife be able to take my money if I transfer it to my retirement account?

By emailing your questions to The Moneyist or posting your dilemmas on The Moneyist Facebook group, you agree to have them published anonymously on MarketWatch.

By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Adblock test (Why?)